What is a Survey Questionnaire?

A survey questionnaire is a research instrument used to collect information or data from respondents. It is a commonly used tool for gaining insights about a particular topic.

Note: Respondent/s refers to the people who provide data by answering questions for the researcher. In simple words, the participants who will answer your survey questionnaire.

In feasibility studies, survey questionnaires are used to understand consumer preferences regarding a particular product or service. The tabulated responses from the participants will help determine whether the proposed business is feasible or not.

What are the parts of a survey form, and how are they constructed?

1. Informed Consent

Before exploring the parts of a questionnaire, let us first understand what “Informed Consent” is. Informed consent is important regarding the ethical and legal aspects of data collection. It includes details about the study, its purpose, a statement of confidentiality, and contact information. It ensures that respondents are willing to participate in the survey and understand its purpose.

Note: The format can be changed depending on what the school requires. In certain schools, informed consent can also be optional. However, it is ideal to understand its importance and know how to create one.

You may use the template below at your convenience:

1.1. Introduction

This section is where you introduce yourselves to the respondents. It gives them the details to whom they will provide their responses.

Sample Template:

We, the [insert your course] students of [insert your school’s name], are surveying to determine the feasibility of “[insert your business name/feasibility study title]” in [insert scope of business (location)].

Sample Introduction:

We, the BS in Business Administration students of XYZ College, are conducting a survey to determine the feasibility of a “Coffee Shop” in Ever Gotesco Mall, Commonwealth Ave., Quezon City.

Note: The location is based on your study, which means it can range from a specific establishment to a certain area.

1.2. Purpose

In this part, the objective of your study or data gathering is discussed with the respondents. It explains why their answers are relevant to your study and how their responses will benefit your marketing research.

Sample Template:

The purpose of the survey for the mentioned feasibility study is to know the market demand of [insert your product/service of interest] in the vicinity of [insert specific location of your scope]. Your responses will serve as a basis for understanding the production and distribution of goods and an ideal marketing strategy for the population.

Sample Purpose:

The purpose of the survey for the mentioned feasibility study is to know the market demand for coffee products near Ever Gotesco Mall, Commonwealth Ave., Quezon City. Your responses will serve as a basis for understanding the production and distribution of goods and an ideal marketing strategy for the population.

Note: The purpose of your data gathering may vary depending on the approach of your study. Make sure to present your aims accordingly to help the respondents understand what your study is for.

1.3. Content

This is where you briefly explain the content of your survey questionnaire. Does it include questions about their demographic profile? Will it be answered through pen-and-paper or online forms? How many questions are there? What type of questionnaire is used? What is the topic of the questions? It helps your respondents know what your questionnaire is about.

Sample Template:

You will be answering details about your demographic profile and complete [insert the number of questions in your survey] questions about your preferences in [insert your product/service of interest], in [insert questionnaire format]. The survey questionnaire will be answered using [insert research instrument used]. Please complete the survey questionnaire with sincerity to avoid bias and improve the reliability of our study.

Sample Content:

You will be answering details about your demographic profile and completing ten (10) questions about your preferences in coffee shops in a multiple-choice format. The survey questionnaire will be answered through online forms. Please complete the survey questionnaire with sincerity to avoid bias and improve the reliability of our study.

1.4. Data Privacy Law

As researchers, it is important to assure your respondents that their details and responses will be kept safe. Any personal information must be used according to the law.

Sample:

Participation in this study is voluntary, and you are allowed to withdraw anytime. This data gathering follows the Data Privacy Act of 2012; rest assured that all data collected will be handled with utmost confidentiality and will be used for academic purposes only.

1.5. Contact Information

The last part of the informed consent includes your contact details or those of the group representative. It allows respondents to contact you if they have questions about the study or wish to withdraw their responses.

Sample Template:

For more information about the study, you are free to contact our group representative, [insert name of representative], through his/her email [insert email address] and contact number [insert contact number]. Please ensure that your queries are related to the study.

Sample Contact Information:

For more information about the study, you can contact our group representative, Juan Dela Cruz, through his email @emailaddress.com and contact number +63 900 000 0000. Please ensure that your queries are related to the study.

Now that we are done with the topic of informed consent, let us proceed with learning the components of a survey questionnaire.

2. Survey Questionnaire

To create a survey questionnaire, we must first understand its key components.

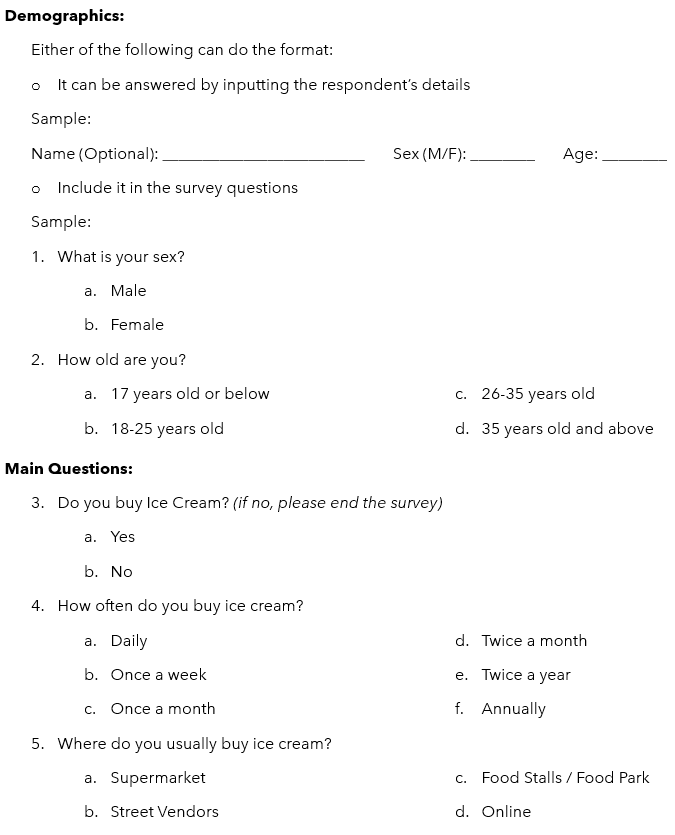

2.1. Demographic Profile

The demographics of the respondents will help you determine your target market. By adding questions like age, gender, location, etc., you may be able to analyze which specific group of people are more likely to avail of your products or services. Knowing the right market for your products or services lets you leverage your business.

2.2. Instructions and Clarifications

Not all questionnaires are easy to answer. Thus, instructions and clarifications are needed to help the respondents understand certain questions. This may include explanations or additional context to ensure that respondents answer the questions correctly.

Instructions

This section is usually presented at the beginning of the questionnaire and provides important context for your respondents, ensuring they understand how to answer your survey questions.

Sample:

- Below are questions about different products bought in a café. If you agree with the statement, choose Yes. If you disagree, choose No.

- Please rate the following services from 1 to 4 based on your satisfaction. See the reference below:

1-Very Unsatisfied | 2–Unsatisfied | 3–Satisfied | 4–Very Satisfied

- Please rank the following products from 1 (most preferred) to 10 (least preferred).

Clarifications

The common application of this is for the questions that are connected or related to the next question. They can also be used to clarify or define difficult words.

Samples:

- Do you buy coffee products in café/coffee shops? (if no, please end the survey)

a. Yes

b. No

- Do you prefer coffee beverages over non-coffee beverages? Yes or No? _____

Choose according to your answer above.

If YES, what coffee beverages do you usually buy? __________

If NO, what non-coffee beverages do you usually buy? __________

- How often do you buy coffee products?

a. Everyday

b. Weekly

c. Monthly

d. Quarterly – every 3 months

e. Semi-annual – every 6 months

f. Annually – every year

- Do you feel bougie buying products from coffee shops compared to your usual community bakery?

“bougie” – rich, luxurious, fancy

a. Yes

b. No

2.3. Survey Questions

- Do you like drinking coffee?

a. Yes

b. No

2. If yes, which coffee blends do you usually buy?a. Macchiato

b. Spanish Latte

c. Americano

d. Cappuccino

e. Others please specify: _____________

Note: Adding “others” as an option allows the respondents to provide insights not listed in the choices. This provides additional information about the consumer’s preferences, which could be used in future studies. Be mindful that this does not apply to all questions.

3. Closing Remarks / Thank you message (Online Forms)

At the end of the survey, the researchers may opt to summarize the purpose of the study and express their gratitude and appreciation to the respondents for their time and participation.

Sample:

Thank you for taking the time to participate in our survey. Your input is invaluable to us, and we greatly appreciate your contributions.

If you have any further suggestions or thoughts you would like to share about the survey, please contact us at our number +63 900 000 0000 and via email @ emailaddress.com. We look forward to your feedback’s positive impact on our efforts and the positive experience we aim to create. Thank you again for being an essential part of our journey.

Note: If you plan to use a pen-and-paper method instead of an online form, this part can be excluded from the form. However, thank your respondents personally after they complete the survey.

IMPORTANT: Avoid copying the exact questionnaire when sourcing other feasibility studies. These studies should only serve as guides and references. Instead, revise and adjust the questions to fit your study. Doing this allows you to gather more useful data and avoid committing a “plagiarism” violation.

What questions should I ask in a survey for a feasibility study?

Formulating survey questions for your feasibility study MUST be aligned with the research Statement of the Problem. The questions you formulate play an important role in preparing all the other aspects of your study, especially in computing the demand and supply and the sales forecast.

Note: You should only ask necessary or useful questions for your study. Please avoid asking questions unrelated to your study, as they could be used against you during your research defense.

Sample:

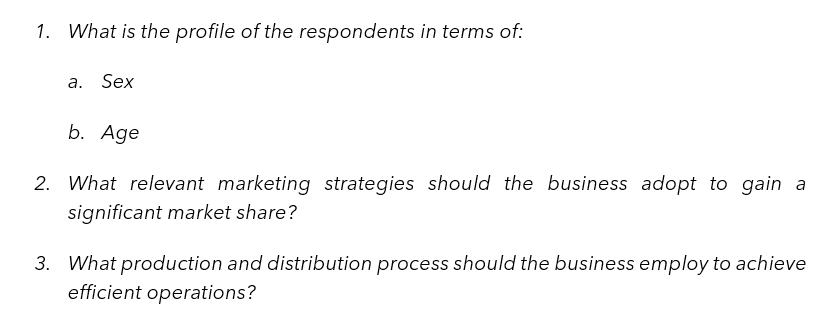

Suppose that your product is Labuyo-Flavored Ice Cream. A part of your Statement of the Problem will be as follows:

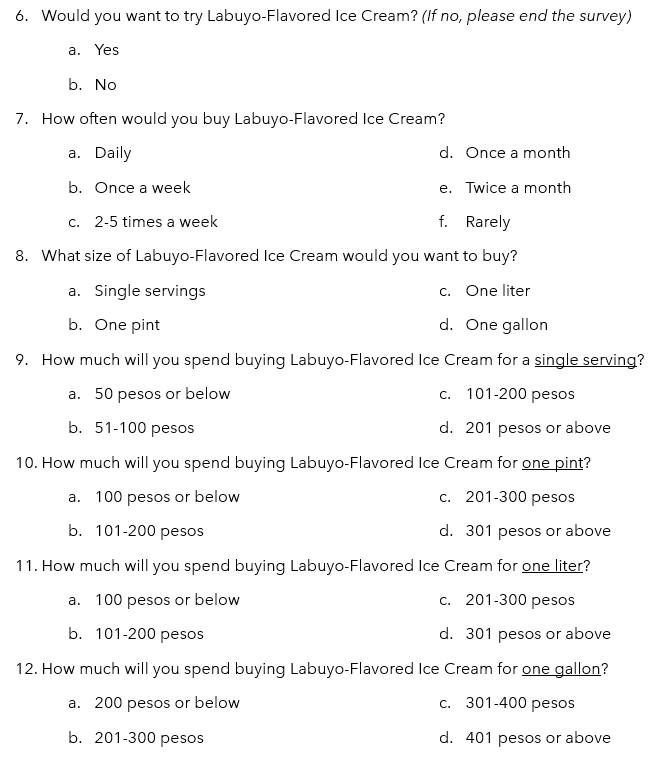

Given the above sample, the questions for your target market could be:

Note: You may also add questions involving your product’s material packaging, preferred design, mode of payment, etc. These can be included depending on your school’s requirements.

Aside from surveying your target market, you should also conduct a survey of your competitors in the area. The questions for the competitors should aim to determine the market supply. You can do this by asking either or all the questions below:

Sample Template:

- How many [insert product or service] are you able to [sell or render] in a [day, month, or year]?

- How much is your average [daily, monthly, or annual] sales?

- How many [insert product or service] can you [produce or accommodate] in a [day, month, or year]?

Sample Questions:

- How many gallons of ice cream can you sell in a month?

- How much is your average annual sales?

- How many gallons of ice cream can you produce in a month?

Note: Unit of measurement and/or specification should be included in the case of products with different variations.

The more competitors you survey, the better it is to measure the market supply accurately.

In case you cannot survey your competitors, you may inquire to the Philippine Statistics Authority (PSA), Department of Trade and Industry (DTI), National Economic and Development Authority (NEDA), Local Government Unit (LGU), or any other related institutions regarding the market supply within your scope and delimitations.

What is the purpose of each question asked in a survey?

As mentioned, you should only ask what is needed or useful for your study. Each question should have a reason why it is asked.

To further understand the purpose of each question asked, let us break down the sample survey given above.

Questions 1 and 2: It answers the first problem in the SOP, stating, “What is the profile of the respondents in terms of Sex and Age?”. You might want to know the gender and age of the respondents if it correlates with the product you will offer. You can use this data to narrow down your target market, allowing you to create more specialized advertisements and increase your market share. Thus, it partly answers the second SOP (“What are the relevant marketing strategies the business should adopt to gain a significant market share?”).

Questions 3 and 4: These questions can be used to determine the demand for goods or services. The percentage of answers will be multiplied by the total population to measure the market demand.

Question 5: It helps you understand the best place to sell your products and significantly increase your market share.

Question 6: This quantifies your initial market share. It can also determine whether or not the consumers will accept your product.

Questions 7 and 8: These questions determine the production and distribution schedule, which partly answers the third SOP (“What kind of production and distribution process should the business employ to achieve efficient business operations?”)

Questions 9 to 12: These questions are used to identify how much the customers are willing to spend. With that insight, you can strategically price your products.

Note: Questions 6 to 12 can also be used to reliably forecast sales.

Questions for the market competitors: These are meant to compute the existing supply of a particular product or service in the market. It also gives you an idea of their sales and production capacity.

Note: If the competitors you are surveying are large companies, you may instead check their financial data.

How to write the survey questions?

Here are some reminders in writing survey questions:

- Questions should be in order. Make sure to be mindful of the sequence of your questions. You wouldn’t ask someone their favorite coffee if they do not drink coffee, right? The order of your questions should make sense. Thus, before asking your respondents about their favorite variant, ask if they are buying the product.

- “No” means stop. In some cases, some questions rely on a prior question. A respondent answering “Yes” may mean they can proceed with the next set of questions while answering “No” could signal the end of the survey. For example, if you are asked whether you drink coffee and answer, “Yes,” the researchers can continue asking about your coffee preferences. However, if you answered “No,” there is no need for you to continue answering questions about coffee.

- Be clear and concise. Avoid using jargon or hifalutin (pretentious) words as much as possible. This ensures that the questions will not confuse the respondents. Use words that are easy to understand and make it direct to the point. Translate the questions into their language if needed.

- Ask no-brainer questions. Remember that you are conducting a survey, not a quiz bee. Your questions should be simple to answer. What you need to know is their opinion and/or personal preferences.

- Avoid bias. Bias affects the credibility of your study and can prevent you from obtaining useful or realistic insights. Don’t limit the respondent’s choices or responses to fit your desired outcome comfortably. Use neutral language to avoid suggesting a particular answer (e.g., Instead of, “Don’t you think the Labuyo-Flavored Ice Cream is good?”, use “How do you feel about the Labuyo-Flavored Ice Cream?” ) and balance the response options to cover a full range of possibilities (e.g., Instead of “very good, good, excellent,” use “very dissatisfied, dissatisfied, satisfied, very satisfied”).

- Use correct grammar and spelling. Make sure to check the grammar and spelling of your survey questionnaire before collecting responses. This helps respondents interpret the questions in your survey more easily.

- Include specific instructions. Some questions may require specific instructions, such as Likert scale or ranking questions. For example, rating something from 1 to 5, a rating of 1 might indicate the best, while 5 indicates the worst. Depending on your scale, this can be done and vice versa, so it is important to add instructions to avoid misunderstandings.

Who should be the respondents of my survey?

First, consider who among the population will serve as your respondents. The respondents of your survey should be none other than your target market. Why is this important? For example, if your product is a feminine wash, would you survey the male population? Of course not. You should only ask females to participate in the survey because they are the ones who will use the product. Before collecting responses, you must first understand the demographics of your target market to ensure the reliability of your study.

How many respondents do I need to survey?

In almost any data-gathering procedure, you must determine the sample size of your study. One way to calculate the sample size for survey questions is by using Slovin’s formula.

In statistics, Slovin’s formula is used to compute the minimum sample size needed to estimate the statistics based on an acceptable margin of error (Bobbitt, 2023).

Slovin’s formula is computed as:

n = N / (1 + Ne2)

Whereas:

n – Sample Size N – Population Size e – Margin of Error

Sample:

Suppose that you are conducting research in the city of Manila, and your target market is females aged 18 years old and above. Let us assume that the female population in Manila aged 18 and above is 800,000. The most common margin of error is 5% (0.05 in decimal format).

To solve for the sample size using Slovin’s formula:

n = 800,000 / (1 + (800,000 x 0.052))

n = 800,000 / (1 + (800,000 x 0.0025))

n = 800,000 / (1 + 2,000)

n = 800,000 / 2,001

n = 399.8 or 400

This means that you need to survey at least 400 females aged 18 and above in the city of Manila to ensure the reliability of the study, with a confidence level of 95% [100% minus the margin of error (5%)].

Note: Keep in mind that the population to be used in this formula should be based on your specific target market, whether it is by the number of individuals, households, businesses, etc.

No time to manually compute sample size?

Use Slovin’s Calculator!

Aside from your target market, you should also conduct a survey of your possible competitors for benchmarking purposes and to compute the market supply. The number of competitors that need to be surveyed may also be computed using Slovin’s formula or as your feasibility study adviser advises.