What are the Financial Ratios?

Financial ratio is a means to gain insights regarding the company’s financial statements. It is a tool that helps business owners or decision-makers to interpret and make sense of raw financial data.

These ratios are crucial for providing an objective way to assess the business’s viability, profitability, and risk.

Common Categories of Financial Ratios

Financial ratios are typically grouped into four main categories, each revealing a different aspect of a company’s financial health and performance.

Liquidity Ratios

These ratios are commonly used to measure the company’s ability to meet its short-term financial obligations.

Common Ratios:

- Current Ratio: Measures the company’s ability to pay its current liabilities with current assets.

Formula: Current Assets ÷ Current Liabilities

- Quick Ratio(Acid-Test Ratio): A more conservative measure of liquidity that excludes inventory, as it’s not always easy to convert into cash.

Formula:(Current Assets − Inventory) ÷ Current Liabilities

- Cash Ratio: The most conservative measure of liquidity, as it measures the company’s ability to pay its current liabilities using only cash.

Formula:(Current Assets − Inventory) ÷ Current Liabilities

Solvency Ratios (or Leverage Ratios)

These ratios assess the company’s ability to meet its long-term financial obligations.

Common Ratios:

- Debt Ratio (Debt-to-Asset Ratio): Measures the percentage of total assets financed by debt.

Formula: Total Liabilities ÷ Total Assets

- Debt-to-Equity Ratio: Compares the total debt of the company to the amount of money invested by its owners.

Formula: Total Liabilities ÷ Total Equity

Profitability Ratios

These ratios measure how well a company generates profits relative to its sales, assets, or equity.

Common Ratios:

- Gross Profit Margin: Measures the percentage of revenue left after deducting the cost of goods sold (COGS) or cost of sales (COS).

Formula: Gross Profit ÷ Revenue

- Operating Profit Margin: Measures the percentage of revenue left after deducting the COGS/COS and the operating expenses.

Formula: Operating Profit ÷ Revenue

- Net Profit Margin: Measures the percentage of revenue left after deducting all the expenses, including interest and taxes.

Formula: Net Income ÷ Revenue

- Return on Assets (ROA): Measures how effectively the company uses its assets to generate profit.

Formula: Net Income ÷ Average Total Assets

- Return on Equity (ROE): Measures how effectively the management uses the equity to generate profits.

Formula: Net Income ÷ Average Total Equity

Efficiency Ratios (or Activity Ratios)

These ratios measure how effectively and efficiently the company uses its resources.

Common Ratios:

- Inventory Turnover Ratio: Shows how many times a company’s inventory is sold or replaced over a period.

Formula: Cost of Goods Sold ÷ Average Inventory

- Receivable Turnover Ratio: Measures how efficiently the company collects its receivables.

Formula: Net Credit Sales ÷ Average Receivables

- Payables Turnover Ratio: Measures how often the payables are paid over a period.

Formula: Net Credit Purchases ÷ Average Payables

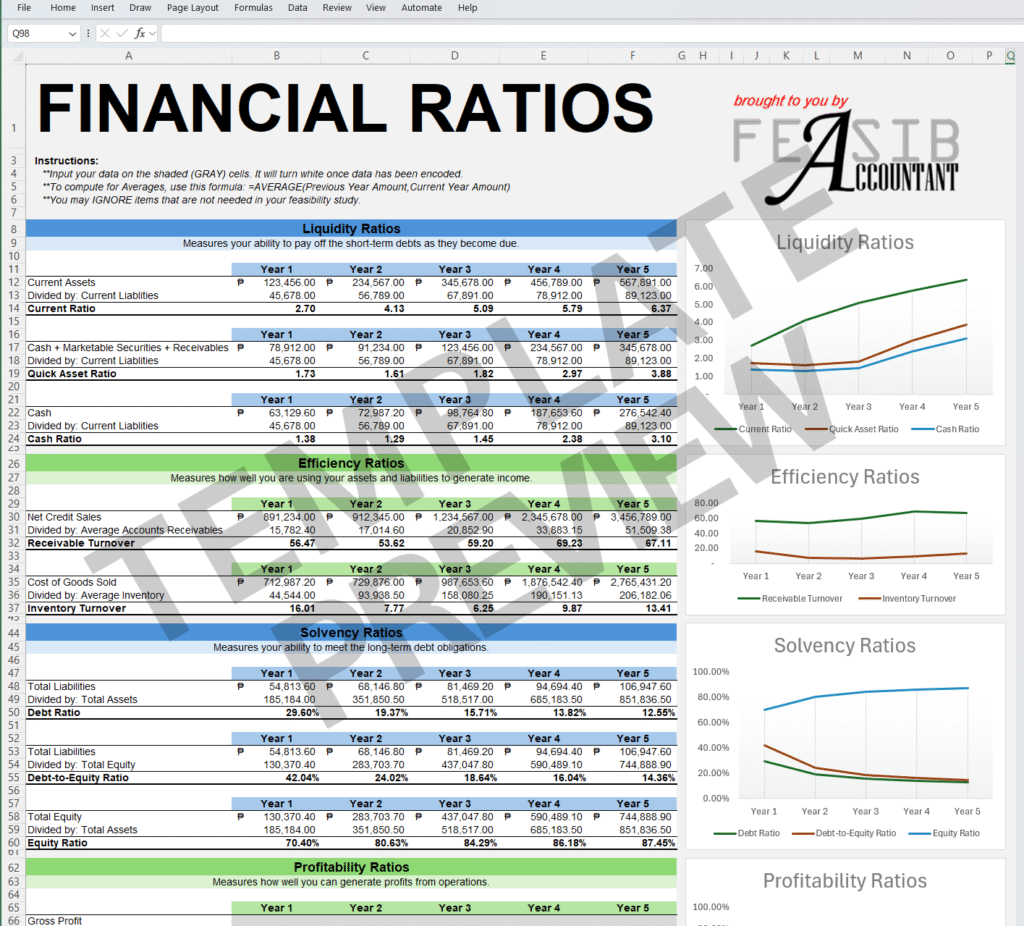

How to use the Feasib Accountant's Financial Ratio template?

All you need do is type or copy and paste your data into our Excel template.

Here are some quick instructions:

- Input your data on the gray-shaded cells. It will turn white once data has been encoded.

- To compute Averages, use either of these formulas:

=AVERAGE(Beginning Balance, Ending Balance)

=AVERAGE(Previous Year Amount, Current Year Amount) - You may IGNORE items that are not needed in your feasibility study.

ENGLISH VERSION

English

TAGLISH VERSION

Taglish

ENGLISH VERSION

English

TAGLISH VERSION

Taglish

Financial Ratios Calculator

Click the button to compute financial ratios using the Financial Ratios Calculator.

⬇️⬇️⬇️