_IMPORTANT NOTICE_

The format or contents of a feasibility study differ from one school to another, but the concepts are usually the same.

Objectives of the Financial Aspect

This section outlines the specific objectives for the financial aspect of a feasibility study.

Objective 1

Provide a detailed list of assumptions for the projected financial statements.

Objective 2

Outline the estimated initial capital requirement or total project cost and state the sources of funds.

Objective 3

Present a comprehensive financial projection and conduct a thorough financial analysis.

Statement of Assumptions

This section details the major financial assumptions that underpin your financial projections.

Financial assumptions usually include the following:

- Initial capital investment.

- Operating year start and end dates (Fiscal or Calendar).

- Operating days per annum.

- Number of units sold annually.

- Annual change in sales.

- Depreciation method of fixed assets.

- Change in operating expenses based on inflation and/or business activities.

- Applicable tax rates.

- Assumed liabilities at the start and the end of the year.

- Owner withdrawals/dividend declaration and issuance.

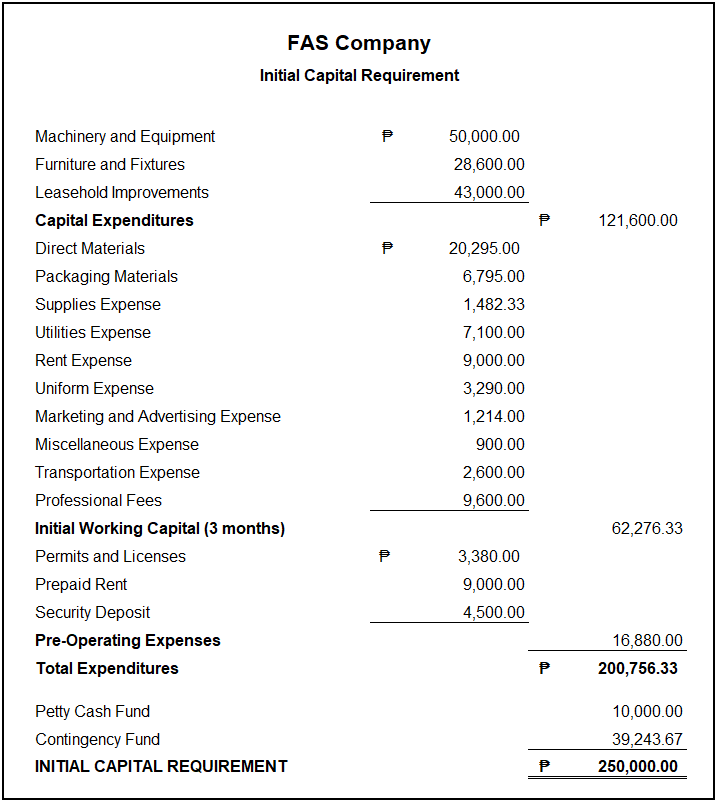

Initial Capital Requirement

This section highlights all the financial expenditures that your proposed business may incur.

To compute the total project cost or initial capital requirement, you need to break down estimated capital expenditures, assumed operating expenses, and contingency fund for a specific period (e.g., annual, quarterly, monthly).

Example:

Projected Financial Statements

This section usually contains the Income Statement, Cash Flow Statement, and Balance Sheet. These statements are usually the prime indicator of whether your proposed business will be feasible or not.

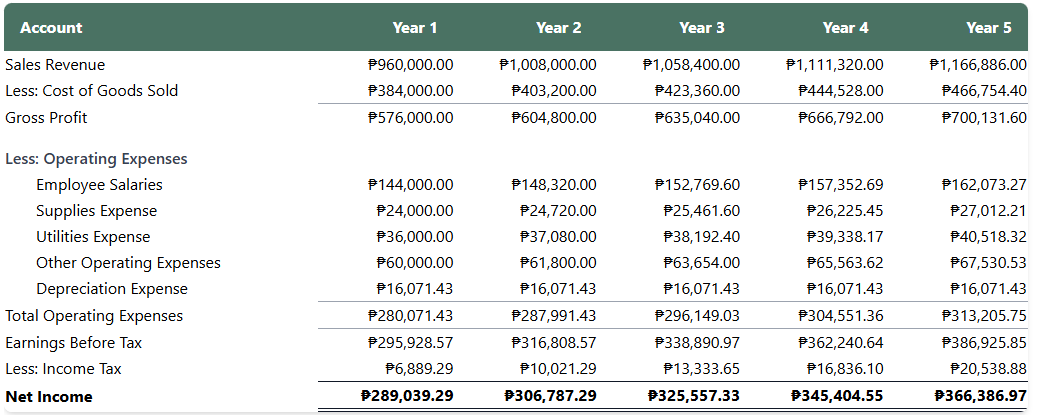

Projected Income Statement

It shows how much you earn and spend during the year. It will help you determine if your business will be profitable or not.

Sample Projected Income Statement

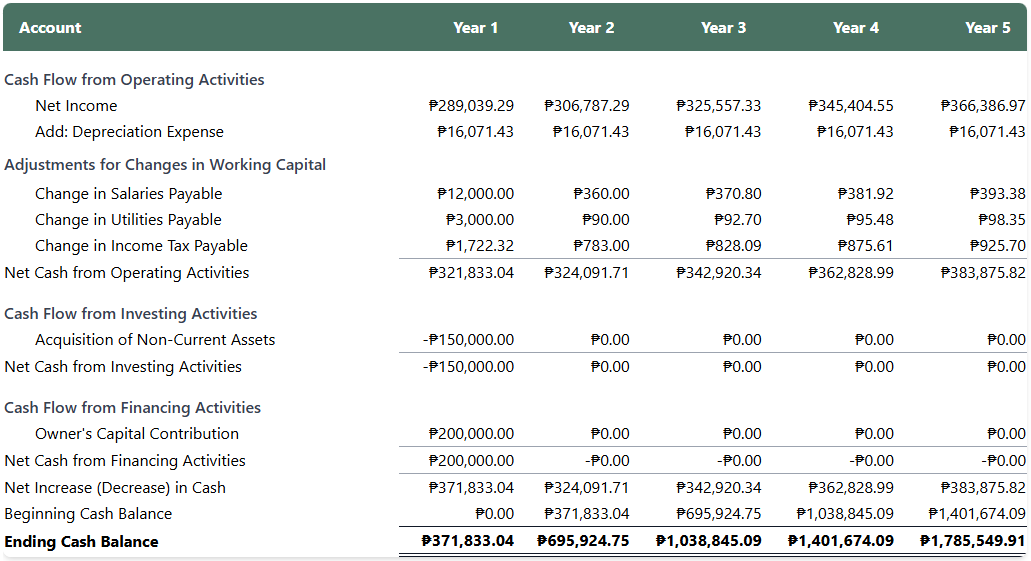

Projected Cash Flow Statement

It helps you determine where your money comes from and where it goes. It also helps you assess if you have enough money to pay bills and invest, so you don’t run out of cash.

Sample Projected Cash Flow Statement

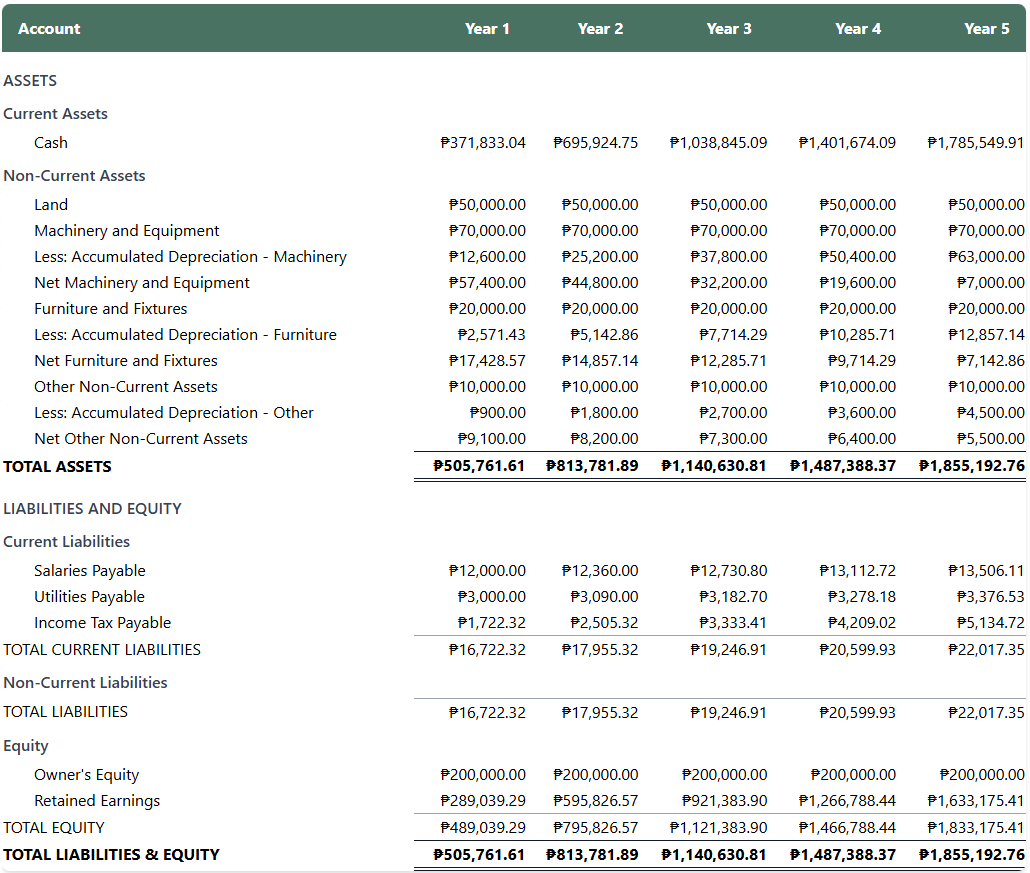

Projected Balance Sheet

This is a future snapshot of everything your business owns, owes, and what’s left over for you at the end of the year.

Sample Balance Sheet

Financial Analysis

This section usually presents ratio analysis, cost-volume-profit (CVP) analysis, and other financial-related analyses.

Need help with your feasibility study?

Contact Feasib Accountant to help you with your feasibility study, especially on the financial aspect of your research.

Why choose Feasib Accountant?

✅Our team specializes in the financial aspects of the feasibility studies, ensuring accuracy and reliability.

✅We understand the academic pressures and deadlines you face, and we are here to support you every step of the way.

✅We ensure to provide your financial statements ahead of time to meet your deadline.

✅We have helped over a hundred groups from different colleges and universities across Luzon, Visayas, and Mindanao successfully defend their feasibility studies with reliable financial computations.

Limited Time Only!

We offer FREE 20-minute consultation to address your concerns about your feasibility study, especially the most tiresome chapter, the financial aspect.

Feasib Accountant is here to provide all the support you need regarding the financial aspect of your study.

DON’T STRESS YOURSELF!

Let the accountant do the accounting. Let’s talk and have your feasib defended!