What is the Break-Even Point (BEP)?

The break-even point analysis is commonly used to determine the minimum quantity of products needed to be sold or the volume of services that must be rendered to ensure that the business will not suffer a loss from its operations.

In simpler terms, it’s the point where your business isn’t making a profit, but it’s also not incurring a loss. Every sale above this point contributes to your profit, while every sale below it results in a loss.

How to compute for the Break-Even Point (BEP)?

Calculating the break-even point is easy and relatively straightforward for businesses offering a single product or service. However, it can be quite challenging for those offering multiple products or services.

Before we jump into examples, let’s quickly remember the key players:

- Fixed Costs (FC): They don’t change no matter how many items you sell (within a relevant range). Think rent, insurance, administrative salaries, equipment depreciation, etc.

- Variable Costs (VC): These are your “per-item” costs. They go up as you sell more. Think raw materials, direct labor for each item, packaging, commissions, etc.

- Selling Price (SP): What you charge customers for one unit of your product or service.

- Contribution Margin (CM): This is the money left over from each sale after covering its direct variable costs. It’s the amount that “contributes” to covering your fixed costs and, eventually, generating profit.

- Contribution Margin per Unit = Selling Price per Unit – Variable Cost per Unit

- Contribution Margin Ratio = (Selling Price per Unit – Variable Cost per Unit) / Selling Price per Unit [or (Total Contribution Margin / Total Sales Revenue)]

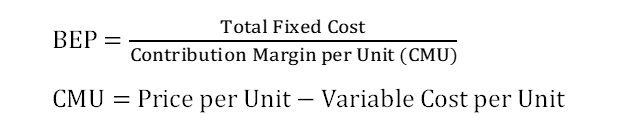

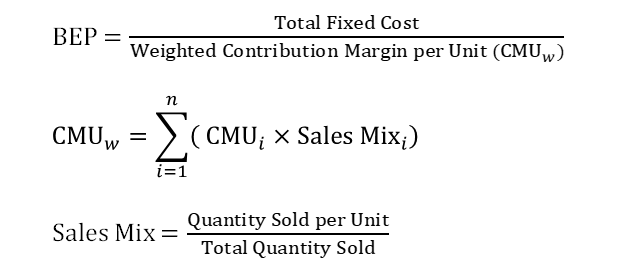

To give you an overview, let’s look at the formulas below:

Single Offer Formulas

Multiple Offers Formulas

The only difference between the computation for single and multiple offers is the need to calculate the sales mix of each product, which can be time-consuming for those with numerous offers.

Scenario 1: Single Offer

This is the simplest case. You’re selling just one type of product or service.

Let’s imagine you’re launching a small online store selling custom-designed phone cases.

Here’s your financial info:

- Fixed Costs (Monthly):

Salaries: ₱15,000.00

Rent: ₱3,000.00

Marketing (social media ads budget): ₱1,000.00

Total Fixed Costs = ₱19,000.00

- Variable Costs per Phone Case:

Blank phone case material: ₱50.00

Printing ink & electricity (per case): ₱15.00

Packaging & shipping material: ₱20.00

Total Variable Cost per Unit = ₱85.00

- Selling Price per Phone Case = ₱250.00

Step 1: Calculate the Contribution Margin per Unit

This tells us how much each phone case contributes to covering your fixed costs.

Contribution Margin per Unit = Selling Price per Unit – Variable Cost per Unit

Contribution Margin per Unit = ₱250.00 – ₱85.00 = ₱165.00

Step 2: Calculate the Break-Even Point in Units

This is how many phone cases you need to sell to cover all your costs.

Break-Even Point (Units) = Fixed Costs / Contribution Margin per Unit

Break-Even Point (Units) = ₱19,000 / ₱165 ≈ 115.15 units

Since you can’t sell part of a phone case, you’d round up to the nearest whole unit or simply add one (1) in case of a decimal to ensure you truly break even.

Break-Even Point (Units) = 116 phone cases

Step 3: Calculate the Break-Even Point in Pesos

This tells you the total peso amount of sales you need to make to cover your costs.

- First, let’s find the Contribution Margin Ratio:

Contribution Margin Ratio = Contribution Margin per Unit / Selling Price per Unit

Contribution Margin Ratio = ₱165.00 / ₱250.00 = 0.66 or 66%

- Then, let’s calculate the Break-Even Point in Pesos:

Break-Even Point (Peso) = Fixed Costs / Contribution Margin Ratio

Break-Even Point (Peso) = ₱19,000 / 0.66 ≈ ₱28,787.87

What this means: You need to sell 116 phone cases, generating at least ₱28,787.87 in sales, just to cover all your monthly expenses. After that, every additional case sold at ₱250.00 will bring in ₱165.00 in profit!

Scenario 2: Multiple Offers

This is a bit trickier because you’re selling different products, each with its own price and cost. To handle this, we need to use a weighted average contribution margin based on your typical sales mix.

Let’s say you own a small bakery that sells two main items: cupcakes and brownies.

Here’s your financial info:

- Fixed Costs (Monthly for the entire bakery):

Rent: ₱8,000

Baker’s Salary: ₱15,000

Utilities: ₱2,000

Depreciation of Equipment: ₱1,500

Total Fixed Costs = ₱26,500

Product Details:

- Product A: Cupcakes

Selling Price per Unit: ₱30.00

Variable Cost per Unit (ingredients, wrapper, frosting): ₱10.00

Contribution Margin per Unit: ₱30.00 – ₱10.00 = ₱20.00

- Product B: Brownies

Selling Price per Unit: ₱40.00

Variable Cost per Unit (ingredients, packaging): ₱12.00

Contribution Margin per Unit: ₱40.00 – ₱12.00 = ₱28.00

Sales Mix (Crucial for multiple products!):

Let’s assume that for every 3 cupcakes you sell, you typically sell 2 brownies. This is your sales mix ratio: 3:2.

There are various ways to compute the sales mix, but for this scenario, let’s use the formula presented above:

- Sales Mix = Quantity Sold per Unit(Product) / Total Quantity Sold

Sales Mix Percentage of Cupcakes: 3 units / 5 units = 0.60 or 60%

Sales Mix Percentage of Brownies: 2 units / 5 units = 0.40 or 40%

Step 1: Calculate the Weighted Average Contribution Margin per Unit

Now, to get the weighted average contribution margin per unit, let’s use the formula presented above:

- Weighted Average Contribution Margin per Unit (CMUw) = ∑ (Contribution Margin per Uniti x Sales Mixi)

Cupcake CMUw: ₱20.00 x 60% = ₱12.00

Brownies CMUw: ₱28.00 x 40% = ₱11.20

Weighted Average Contribution Margin per Unit: ₱12.00 + ₱11.20 = ₱23.20

Step 2: Calculate the Overall Break-Even Point in Units

Break-Even Point = Fixed Costs / Weighted Average Contribution Margin per Unit

Break-Even Point = ₱26,500.00 / ₱23.20 ≈ 1,142.24 units

Again, you can’t sell a partial unit, so let’s round up:

Overall Break-Even Point (Total Units) = 1,143 units

Step 3: Break Down the Break-Even Point by Product

Now that we know the total number of units we need to sell (1,143), we can apply our sales mix ratio (3:2) to find out how many of each product that represents.

For Cupcakes: (3 / 5) x 1,143 units ≈ 686 cupcakes

For Brownies: (2 / 5) x 1,143 units ≈ 457 brownies

(Note: If you sum 686 + 457, you get 1143. If there are slight rounding differences, it’s usually due to the initial overall unit calculation being rounded up.)

Step 4: Calculate the Break-Even Point in Pesos

This tells you the total sales amount needed for the whole bakery.

- First, calculate the Weighted Average Contribution Margin Ratio:

Total Contribution Margin: (3 cupcakes * ₱20.00) + (2 brownies * ₱28.00) = ₱60.00 + ₱56.00 = ₱116.00

Sales Revenue: (3 cupcakes * ₱30.00) + (2 brownies * ₱40.00) = ₱90.00 + ₱80.00 = ₱170.00

Weighted Average Contribution Margin Ratio = Total CM / Total Sales Revenue

Weighted Average Contribution Margin Ratio = ₱116.00 / ₱170.00 ≈ 0.6824 or 68.24%

- Then, let’s calculate the Break-Even Point in Pesos:

Break-Even Point (Peso) = Fixed Costs / Weighted Average Contribution Margin Ratio

Break-Even Point (Sales Revenue) = ₱26,500 / 0.6824 ≈ ₱38,833.53

What this means: To break even, your bakery needs to sell about 686 cupcakes and 457 brownies, generating approximately ₱38,833.53 in total sales revenue. This means the baker knows exactly how many of each item they need to sell to keep the doors open before even thinking about profit.

FREE Break-Even Analysis Template

How to use Feasib Accountant’s break-even template?

First, download the Break-Even Template to your device.

Then, simply fill in your data in the white-shaded cells in the template, and it will automatically compute the break-even point for you.

You may opt to edit the format or hide the empty cells at your convenience for presentation purposes.

Need help with your feasibility study?

Contact Feasib Accountant to help you with your feasibility study, especially on the financial aspect of your research.

Why choose Feasib Accountant?

✅Our team specializes in the financial aspects of the feasibility studies, ensuring accuracy and reliability.

✅We understand the academic pressures and deadlines you face, and we are here to support you every step of the way.

✅We ensure to provide your financial statements ahead of time to meet your deadline.

✅We have helped over a hundred groups from different colleges and universities across Luzon, Visayas, and Mindanao successfully defend their feasibility studies with reliable financial computations.

Limited Time Only!

We offer FREE 20-minute consultation to address your concerns about your feasibility study, especially the most tiresome chapter, the financial aspect.

Feasib Accountant is here to provide all the support you need regarding the financial aspect of your study.

DON’T STRESS YOURSELF!

Let the accountant do the accounting. Let’s talk and have your feasib defended!